Medium-Term Management Plan

About “Contributing to Progress in Society 2027”

Starting this year, we are promoting our second three-year medium-term management plan, "Contributing to Progress in Society 2027." This plan will be part of our long-term management objective, Vision 2030. In 2024, the Group formulated a business concept referred to as "Contributing to Progress in Society." This concept is a new form of business in which our group with think tanks and consulting functions creates a cycle from proposing issues to solving through technology through collaboration with our core system integration functions.Leveraging the business foundation expanded in the previous medium-term management plan, we will aim for further growth through more aggressive challenges than ever before.

Contributing to Progress in Society 2027

Enhancing and leveraging our capabilities to support

the activities of corporations and other organizations, and to contribute to progress in society.

Priority Measures

Ⅰ. Value creation for corporate and social transformation

Integration of sales personnel

We will integrate sales functions into the recently established General Sales Headquarters, thus creating a system that will enable the entire Company to respond consistently to complex and wide-ranging customer expectations.

To accelerate the acquisition of new business opportunities and provide greater value, we will strengthen the areas of account sales, solution sales, and partner sales.

Integration of engineers

We will merge the majority of our technology functions into the Technology Headquarters we recently set up. This will allow for the sharing, across business boundaries, of skills and expertise, as well as the flexible allocation of personnel.

We will accelerate business growth by developing leaders in advanced digital project management; improving project quality; as well as rapidly and flexibly allocating personnel in response to changes in the business environment.

Ⅱ. Enhancement of competitive solutions

Utilization of cutting-edge technologies

We will utilize generative AI and other innovative technologies to strengthen the competitiveness and profitability of our solutions.

Promotion of external collaboration

We will enhance our capabilities and expand into new areas of business through partnerships and M&A with the Dentsu Group, other corporations and organizations, as well as academia.

Strengthening of proprietary solutions

We will increase R&D and product investments to further buttress the competitive advantages of our proprietary solutions.

We also will set up a dedicated organization to plan, develop, and launch new businesses that will develop new areas of business by 2030.Ⅲ. Strengthening of management

Reform of management system

We will promote DX, sustainability activities, and advanced management controls across all business and corporate divisions. This will enable us to improve productivity and profitability over the medium to long term, and so enhance corporate value.

Strengthening human capital

We will leverage recruiting capabilities enhanced under the previous medium-term management plan; continue to hire talented human resources; and implement training measures and other initiatives to improve mobility in order to maximize the abilities and performance of each individual employee.

Targeted Management Indicators

The DENTSU SOKEN Group places great importance on maximizing the added value we provide for clients, and on enhancing corporate value. Under the new medium-term management plan, we have set targets for the five quantitative indicators of net sales, operating profit, operating profit margin, ROE, and number of employees for the fiscal year ending December 2027. In addition, we have a growth investments limit to achieve these targets.

Quantitative Targets

- Net sales

- ¥210 billion CAGR* +11.2%

- Operating profit

- ¥31.5 billion CAGR* +14.4%

- Operating margin

- 15 %

- ROE

- 18 % or higher

- Number of Employees

- 6,000 people CAGR* +10.8%

-

*FY2021–24 compound annual growth rate (CAGR).

Allocation for Growth Investments

- R&D, improve internal productivity, and M&A, etc. (Three-year cumulative)

- ¥75 billion

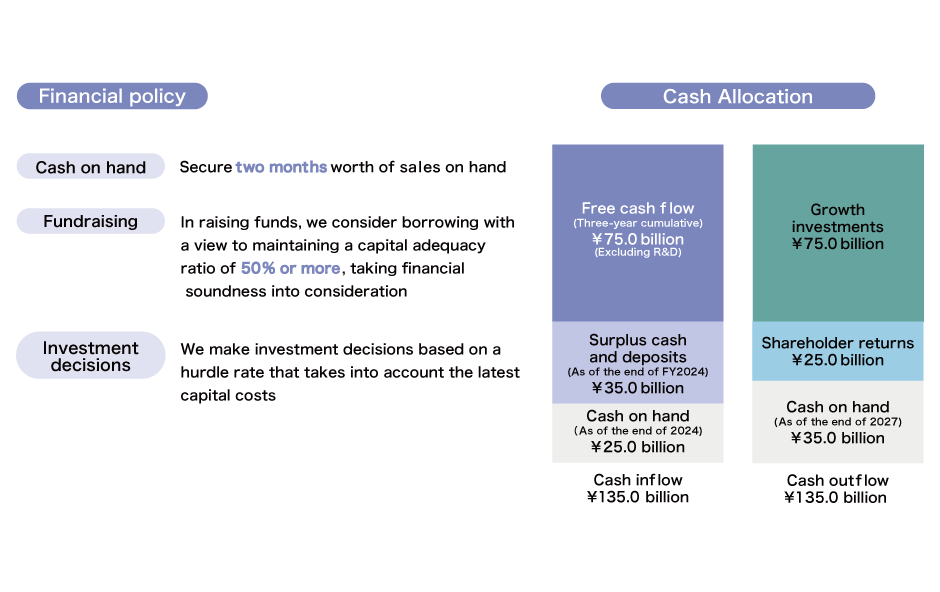

Financial Policy

The Group’s finance-related policy is to have a sound financial foundation, while at the same time investing in growth areas and providing shareholders with stable returns. Its goal is to sustainably enhance corporate value over the long term.

In line with this policy, we will set aside a growth investment budget of ¥75.0 billion, from our cash reserves and the free cash flow expected over the next three years, while cash on hand will be secured by approximately 2 months of sales.

Further, in the process of investing and pursuing M&A, we will make investment decisions based on strict standards, taking into account the cost of capital.

Yet, in order to achieve disruptive growth, we will also consider raising funds by borrowing, if necessary, aiming to maintain an equity ratio of 50% or more.

Financial Policy

Financial Policy

Shareholder Returns

The Group’s basic dividend policy is to maintain an appropriate level of steady dividends, while retaining sufficient internal reserves to ensure sustained growth.

Accordingly, we will strengthen shareholder returns through earnings growth and an improved dividend payout ratio. We have targeted a consolidated dividend payout ratio of 40% or more, but we will aim to improve it from 46.5% in FY2024 to 50% in FY2027.