Corporate Governance

Approach

Based on our mission of “Acting with sincerity, we contribute to progress and harmony among our customers, consumers, and society by exploring the unlimited potential of technology,” DENTSU SOKEN recognizes the important role of corporate governance for the business environment in order to execute swift, fair and transparent management that realizes healthy and continuous growth. DENTSU SOKEN’s Corporate Governance Policy reflects this approach. The Board of Directors works to enhance corporate governance by reviewing policies as related laws and regulations are revised, and the social and economic business environment changes.

Structure

Board of Directors and Audit and Supervisory Committee

The Board of Directors determines important matters affecting DENTSU SOKEN and supervises how business is conducted, while the Audit and Supervisory Committee and its members are responsible for auditing management. The Board of Directors comprises nine directors, of whom six are Outside Directors. The five of Outside Directors have been appointed as independent officers as provided for by the Tokyo Stock Exchange, and more than half the Board members are independent Outside Directors. The Audit and Supervisory Committee has three members, of whom two are independent officers.

Nomination and Remuneration Committee

This is a voluntary committee, under the aegis of the Board of Directors. The chairman and more than half the committee members are independent Outside Directors. It serves to discuss the appointment and dismissal of directors, and executive officers, etc. representative directors and others (including the CEO), as well as matters related to the remuneration of directors (including representative directors).

As of March 24, 2025, following the 50th Ordinary General Shareholders Meeting, the composition of the Nomination and Remuneration Committee is as follows:

Mio Takaoka, Director (Independent, Outside) – Chairperson

Yukari Murayama, Director (Independent, Outside)

Hirohisa Iwamoto, Representative Director and President

Executive Officers

DENTSU SOKEN has adopted an Executive Officer system to strengthen its business execution function. All Directors involved in execution also serve as Executive Officers, enabling faster decision-making and clearer accountability.

Management Council, Other Committees

The Management Council was set up to help expedite management decisions and streamline operations, in order to resolve important management matters other than those resolved by the Board of Directors and, in advance, to deliberate matters to be resolved by the Board of Directors.

The President and CEO chair the council, which comprises members selected from among executive officers by a resolution of the Board of Directors and outside directors who are full-time Audit and Supervisory Committee members.

In addition, under the Sustainability Policy, we have established the Sustainability Promotion Council with the aim of comprehensively promoting initiatives related to sustainability in the Group, summarizing information on risks assumed in DENTSU SOKEN and Group's business activities and promoting responses in accordance with the level of importance of risks from a company-wide perspective.

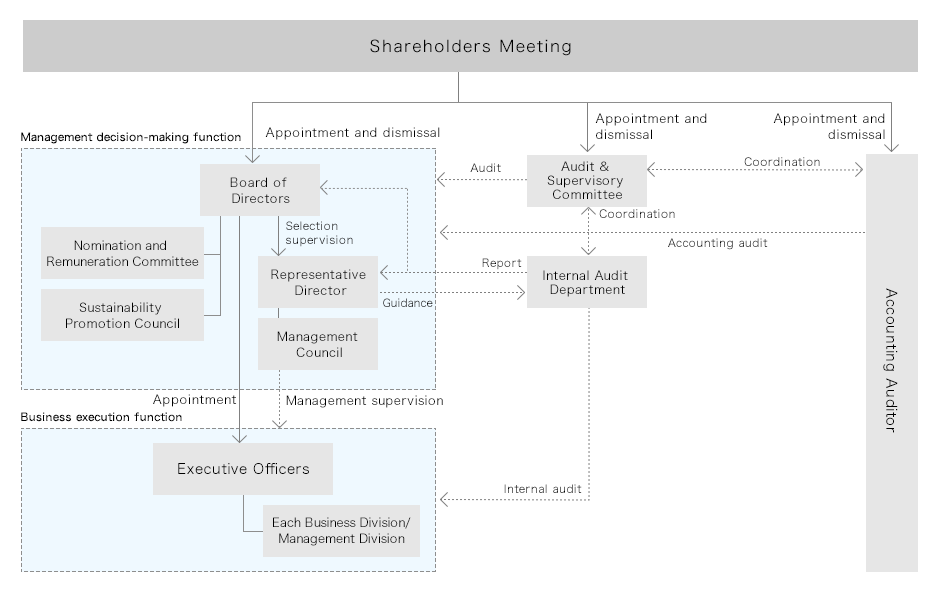

The DENTSU SOKEN corporate governance structure is as follows.

Organizational chart

Organizational chart| Title | Name | Board of Directors | Nomination and Remuneration Committee |

|---|---|---|---|

| Representative Director | Hirohisa Iwamoto |

10/10 meetings |

6/6 meetings |

| Director | Shinichi Ogane |

13/13 meetings |

- |

| Director2 | Mio Takaoka |

12/13 meetings |

- |

| Director2 | Tomoko Wada |

13/13 meetings |

- |

| Director2 | Reiko Yasue4 |

- |

- |

| Director | Chisato Matsumoto |

10/10 meetings |

- |

| Director/Audit and Supervisory Committee Members3 | Atsuhiro Sekiguchi |

13/13 meetings |

- |

| Director/Audit and Supervisory Committee Members2 | Yukari Murayama |

12/13 meetings |

6/6 meetings |

| Director/Audit and Supervisory Committee Members2 | Masahiko Sasamura |

13/13 meetings |

- |

Notes:

-

1Attendance records from January 2024 to December 2024

-

2Outside & Independent

-

3Outside

-

4Newly elected from March 2023

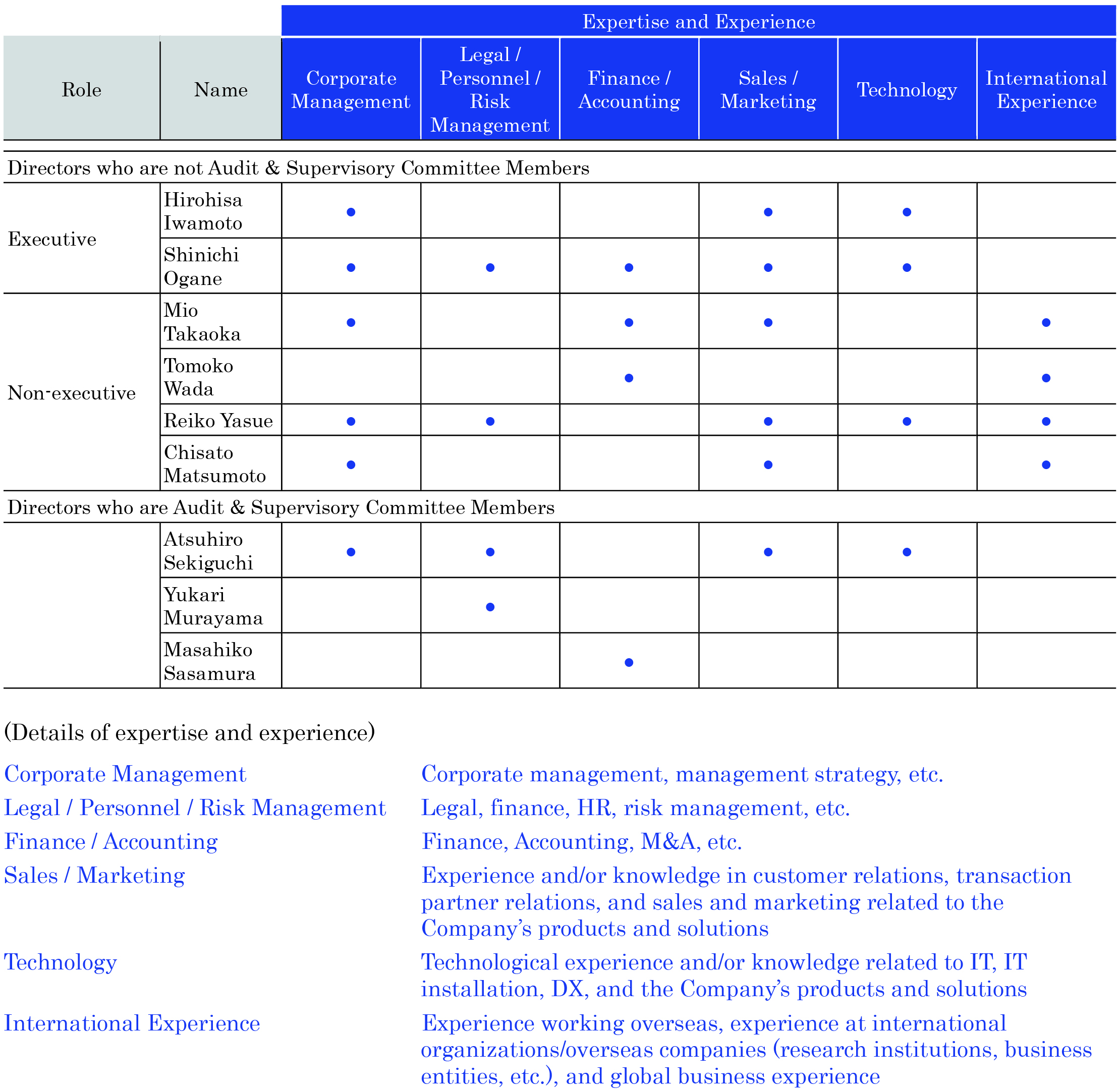

Skill Matrix

Evaluating the Board of Directors

DENTSU SOKEN evaluates the effectiveness of the Board of Directors to improve its effectiveness and enhance corporate value.

Issues and initiatives identified in the previous effectiveness assessment

-

1.Further Promotion of Communication Within and Outside the Board of Directors

Meetings were held between Independent Outside Directors and executive management (Directors involved in business execution) to provide explanations and engage in discussions on important matters. -

2.Enhancement of Discussions on Long-Term Strategies, Especially Strategic Investments (e.g., M&A)

Progress reports and discussions were conducted regarding M&A activities and the formulation of the next medium-term management plan. -

3.Strengthening the Board’s Supervisory System on Nomination and Remuneration

An activity plan for the Nomination and Remuneration Committee through March 2025 was formulated and reported to the Board of Directors. Additionally, the following matters were examined and reported to the Board as appropriate.-

[Nomination Area]- Implementation of the selection process for Director candidates

- Review of nomination criteria (e.g., age limits, term of office)

- Consideration of the new management structure for the next fiscal year

- Succession planning -

[Remuneration Area]- Introduction of ESG-related indicators into the executive officer remuneration system

- Review of the next stock-based compensation plan

-

Evaluation Overview

| Implementation period: | November 2024 ~ December 2024 |

| Eligibility: | All directors, including Audit and Supervisory Committee members (9 persons) |

| Target Process: | (1) Named questionnaire survey (5 sections, 25 questions in total) Main evaluation items: |

| (Main evaluation items) ・Composition and operation of the Board of Directors ・Medium-term management plan and budget, response to sustainability ・Observance of corporate ethics and risk management ・Nomination, remuneration and evaluation of management ・Dialogue with shareholders * In addition to a five-point evaluation for each question, write a comment in the free description field provided for each part. |

|

| (2) Individual interviews with newly appointed part-time Directors conducted by the Secretariat | |

| (3) Compilation of analysis and evaluation reports by external experts | |

| (4) Resolution of the Board of Directors on the effectiveness evaluation of the Board for FY2024 |

Evaluation Results

Since all evaluation items were rated as effective or generally effective, the overall effectiveness of the Board of Directors is considered to be ensured. In addition, positive feedback was received on the following: active discussions are held in an open and constructive atmosphere; issues are addressed based on a proper tension fostered through mutual trust between executive and supervisory functions; and issues identified in the previous evaluation have been steadily addressed.

In light of these results, DENTSU SOKEN will continue its efforts to further enhance the effectiveness of the Board of Directors in fiscal 2024 by addressing the following key areas:

-

1.Promoting communication within and outside the Board of Directors

We will promote active communication among Directors by creating more opportunities for exchanging views and sharing information on key management issues. -

2.Deepening discussions on medium- to long-term strategies, including investments

We will facilitate discussions on strategic direction through progress reports on the new medium-term management plan and updates on strategic investments, including M&A. -

3.Strengthening the Board’s oversight on nomination and remuneration

We will report on the activity plans and discussion items of the Nomination and Remuneration Committee to the Board of Directors and begin implementing a succession planning process starting this fiscal year.

DENTSU SOKEN will continue to make improvements and address all issues indicated, in order to increase the Board’s effectiveness.

As required by Tokyo Stock Exchange regulations, matters pertaining to DENTSU SOKEN’s corporate governance can be found in the Corporate Governance Report.

Nomination Criteria, Requirements for Independence as Outside Director

-

Nomination Criteria for Executive Director Candidates

-

(1)Ability to make decisions from the standpoint of ensuring the DENTSU SOKEN Group’s sustainable growth and maximization of medium- to long-term corporate value

-

(2)Possessing expertise related to the DENTSU SOKEN Group’s operations

-

(3)Superior imagination, decision-making ability, and leadership

-

(4)Possessing the dignity, character, insight, popularity, and morality appropriate for a Director

-

-

Nomination Criteria for Outside Director Candidates

-

(1)Possessing abundant experience and specialized knowledge in fields including management, law, finance and accounting, information technology, corporate governance, and risk management

-

(2)Expert ability to understand management issues and risk, and to perform monitoring

-

(3)Ability to proactively provide a personal opinion from a neutral standpoint

-

(4)Possessing the dignity, character, insight, popularity, and morality appropriate for a Director

-

(5)Ability to maintain independence from the Company’s Chief Executive Officer (CEO),etc.

-

-

Requirements for Independence as Outside DirectorThe Company will deem that Outside Directors (including candidates) possess independence if they meet the requirements for independent officer as provided for by the Tokyo Stock Exchange and if they do not correspond to items (1) to (3) below.

-

(1)Being a major shareholder (holding 10% or more of voting rights either directly or indirectly) or person who executes operations at the Company

-

(2)Being the person who executes operations at a transaction partner* that exceeds the standards set by the Company

-

(3)Being a consultant, accounting specialist, or legal specialist that has received over 10 million yen in cash or other financial benefit outside of their officer compensation in a single fiscal year in any of the past three fiscal years (where the entity receiving these assets is a group such as a corporation or association, this refers to persons belonging to that group)

-

*A transaction partner that exceeds the standards set by the Company is any transaction partner whose transactions with the Company make up over 2% of the Company’s consolidated net sales in a single fiscal year in any of the past three fiscal years.

-

Remuneration System for Directors

-

Basic Policy(Remuneration Levels)

Remuneration levels are set in consideration of the Company’s performance, the responsibilities and roles of its respective directors, and a wide range of information regarding rates of directors’ compensation. Furthermore, remuneration is set at levels high enough to attract highly qualified personnel.(Remuneration structure)

Remuneration of directors who concurrently serve as executive officers is comprised of a fixed salary and, as incentives for achieving financial targets, an annual bonus linked to consolidated financial results and stock compensation linked to results over the medium to long term.

Remuneration of directors who do not concomitantly serve as executive officers (regardless of whether or not they are members of the Audit and Supervisory Committee) is a fixed salary only since their management supervision roles require a high degree of independence.

The Company has abolished its retirement benefit plan for directors, and, therefore, will not pay such benefits in the future.(Process for determining remuneration amounts)

For Directors who are not Audit and Supervisory Committee Members, fixed remuneration is determined by the President and CEO with the approval of the Board of Directors, within the total amount approved at the General Meeting of Shareholders, and after prior deliberation by the Nomination and Remuneration Committee, the majority of whose members are independent outside directors to ensure objectivity and transparency. Annual bonuses are determined by a resolution of the Board of Directors following prior deliberation by the Nomination and Remuneration Committee. Stock compensation is granted in accordance with the provisions of the stock compensation rules approved by the Board of Directors.

Remuneration for Directors who are Audit and Supervisory Committee Members is determined through consultation among those Directors, within the total amount approved at the General Meeting of Shareholders.

Matters Concerning the Remuneration of Directors Approved at the General Meeting of ShareholdersResolutions regarding Directors' remuneration were made at the 48th Ordinary General Meeting of Shareholders held on March 24, 2023 and the 50th Ordinary General Meeting of Shareholders held on March 24, 2025, as outlined below:

(Remuneration for Directors who are not Audit and Supervisory Committee Members)

-

Up to 400 million yen per year, including bonuses (of which up to 50 million yen per year is for Outside Directors). Salaries for Directors who also serve as employees are excluded.

-

Separately, stock compensation is granted to Executive Directors and Executive Officers. The upper limit for such stock compensation is 240,000 shares and 1.05 billion yen in total over the applicable fiscal years of the medium-term management plan.

(Remuneration for Directors who are Audit and Supervisory Committee Members)

-

Up to 50 million yen per year.

Breakdown of Remuneration of Directors Who Concurrently Serve as Executive Officers1 (Effective from the Fiscal 2025)Fixed Remuneration Paid monthly based on the position and role Performance-linked Remuneration Annual Bonus Determined and paid based on the achievement of performance evaluation indicators, by referencing the ratio to employees’ annual bonuses against their monthly salary Stock Compensation*2 Using a trust established by the company, points are calculated based on monthly remuneration by role. About 70% is based on performance achievement, while the remaining 30% is allocated annually as fixed points. At a set time after the final fiscal year of the medium-term management plan, the number of shares is calculated based on total accumulated points and granted accordingly. Notes:

-

1If the upper targets for performance indicators are achieved, the approximate ratio of the remuneration structure will be: fixed remuneration 45%, annual bonus 30%, and medium- to long-term performance-linked stock compensation 25%.

-

2If any misconduct or similar issue is identified, the system allows for all or part of the recipient’s rights to receive stock compensation to be forfeited, and for the company to seek compensation equivalent to the granted shares.

Performance Evaluation Indicators (Effective from the Fiscal 2025)Performance Indicators for Annual Bonus Weighting Consolidated Operating Profit (vs. Initial Plan) 90% Consolidated Operating Profit (vs. Previous Fiscal Year) Profit Attributable to Owners of Parent Engagement Score* 5% Percentage of Female Hires* 5% Performance Indicators for Stock Compensation Weighting Consolidated Net Sales Approx. 90% Consolidated Operating Profit Consolidated ROE ESG-Related Indicators* Approx. 10% -

*Selected from the Company's KPIs for material issues and evaluated based on the level of achievement of those goals.

Total Amounts of Remuneration in Fiscal 2024Role Total Amount of Remuneration

(millions of yen)Total Amount of Remuneration by type

(millions of yen)Number of eligible directors and officers

(person)Fixed Salaries Annual Bonuses Retirement benefits Stock compensation Directors who do not concurrently serve as members of the Audit and Supervisory Committee

(excluding Outside Directors)123 89 12 - 21 5 Directors who concurrently serve as members of the Audit and Supervisory Committee

(excluding Outside Directors)- - - - - - Outside Directors and Auditors

61 61 - - - 6 Notes:

-

1The amounts above include two directors who stepped down at the end of their terms in office as of the date of the 49th General Meeting of Shareholders held on March 22, 2024.

-

2The total amount of stock compensation is recorded as an expense in the relevant fiscal year.

-

Internal Controls

The DENTSU SOKEN Group maintains an Internal Control System to ensure business is conducted appropriately, based on its Basic Policy. Internal audits are conducted by the Internal Audit Department in accordance with IIA standards. Results are reported to the Representative Director, the Board of Directors, and the Audit and Supervisory Committee. External assessments were conducted in 2016 and 2021, with a "Generally Conforms" rating (highest level).

For more details, refer to the Basic Policy on Internal Control Systems (Japanese only).

The operational status of internal controls is disclosed in the Securities Report.

Internal Audit System

Based on the IIA International Standards1,the Company conducts annual risk-based internal audits2 on the Group’s governance, risk management and control processes. The primary audit themes (focus points) are whether the Company’s systems, organizations, regulations, and other matters are properly established and operated, whether business processes are conducted in accordance with laws, regulations, official guidelines, the Company’s code of conduct, internal regulations, and other requirements, and whether risk management and control mechanisms are functioning appropriately and rationally. Subsidiaries are also included in the organizations that are audited.

Internal audits are conducted by the Internal Audit Department, which reports the results of the audits to Representative Director, the Board of Directors, and the Audit and Supervisory Committee. The Representative Director then instructs the relevant organization to make improvements as necessary. The annual plan for internal audits is approved by the Board of Directors, and progress and performance reports are submitted on a regular basis.

In addition, the full-time Audit and Supervisory Committee member and the Internal Audit Department meet once a month to exchange information and opinions regarding the status and results of internal audits, as well as information that will contribute to improving the Group's internal controls and operations. The Internal Audit Department and the accounting auditor additionally collaborate by sharing information and exchanging opinions as necessary.

Moreover, the Internal Audit Department is working on various measures to improve the quality of internal audits. In addition to conducting annual internal assessments, the Department also undergoes external assessments once every five years. In 2016 and 2021, the Department underwent external assessments of the quality of its internal audits, and was rated “Generally Conforms,” the highest of three levels, for compliance with the IIA international standards.

-

Notes:

-

1The International Standard for the Professional Practice of Internal Auditing established by the Institute of Internal Auditors (IIA), an international organization for internal audits.

-

2This is an approach in which a risk assessment is conducted on potential audit units (auditable units encompassing organizations, processes, themes, and other matters that may be selected as the subject of individual audit work) and audit resources are allocated to those with the highest priority. This approach is also described in the IIA international standards.

-